Are PCORI Fees Still Required for Self-Insured Health Plans in 2025? Everything You Need to Know

If your company sponsors a self-insured health plan, you might be wondering whether you still need to pay Patient-Centered Outcomes Research Institute (PCORI) fees. These fees, which fund research on patient-centered outcomes, have been a requirement for several years. However, there have been changes to the legislation that you should be aware of. In this post, we’ll clarify the current requirements for PCORI fees and what you need to do to stay compliant.

What Are PCORI Fees?

PCORI fees are paid by health insurers and sponsors of self-insured health plans. The funds collected are used to support research that helps patients, clinicians, purchasers, and policymakers make informed health decisions.

Legislative Background

Initially, PCORI fees were required for plan and policy years ending before October 1, 2019. For calendar-year plans, this meant that the 2018 plan year was supposed to be the last year for which these fees applied. However, budget legislation passed in 2019 reinstated the PCORI provision, extending the fee requirements through plan years ending before October 1, 2029.

Current Requirements

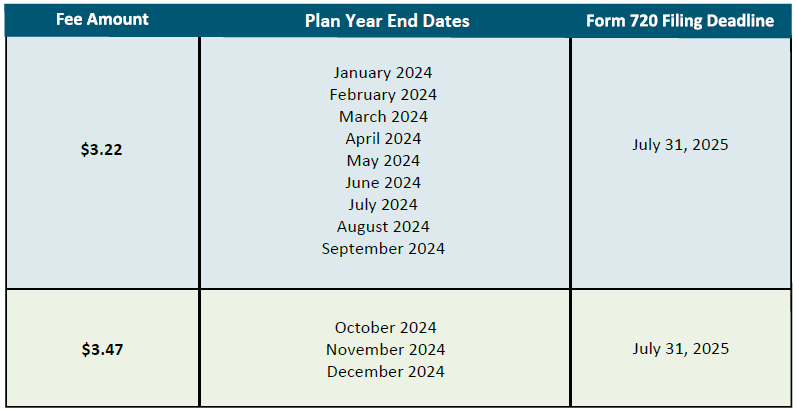

As of now, if your self-insured health plan’s policy year ends on December 31, 2024, you are required to pay the PCORI fee. This fee is considered an excise tax under the Internal Revenue Code and must be reported on IRS Form 720. Although Form 720 is filed quarterly for other federal excise taxes, the PCORI fee reporting and payment are only required annually. The deadline for filing Form 720 for the 2024 plan year is July 31, 2025.

Record-Keeping

The instructions for Form 720 advise taxpayers to keep their tax returns, records, and supporting documentation for at least four years from the latest of the date the tax became due or the date the tax was paid. This is crucial for ensuring compliance and being prepared for any potential audits.

Conclusion

In summary, PCORI fees are still required for self-insured health plans through plan years ending before October 1, 2029. Make sure to file IRS Form 720 by July 31, 2025, for the 2024 plan year, and keep all related documentation for at least four years. Staying informed and compliant will help your company avoid any penalties and contribute to valuable health outcomes research.

Source: Thomson Reuters