HSA Contribution Limits for Spouses with Self-Only HDHP Coverage

Health Savings Accounts (HSAs) are a valuable tool for managing healthcare expenses, especially for those enrolled in high-deductible health plans (HDHPs). However, understanding the contribution limits can be tricky, particularly for married couples with self-only HDHP coverage. In this post, we’ll clarify whether spouses with self-only HDHP coverage can share their HSA contribution limits and provide insights into maximizing their contributions.

HSA Contribution Limits

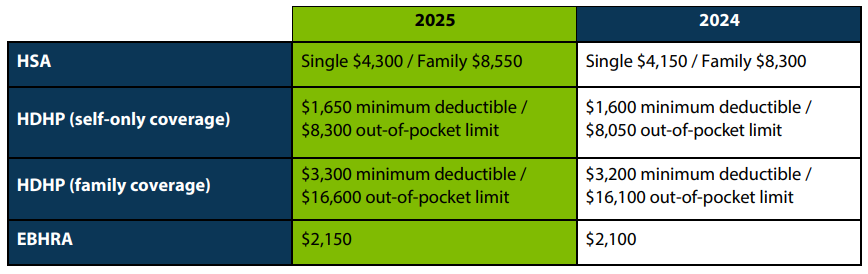

For 2025, the HSA contribution limits are as follows:

- Self-Only HDHP Coverage: $4,300

- Family HDHP Coverage: $8,550

Additionally, individuals aged 55 or older can make a “catch-up” contribution of up to $1,000 to their HSA.

Special Rule for Married Individuals

When at least one spouse has family HDHP coverage, a special rule allows the spouses to share the higher family contribution limit. Either spouse’s HSA can receive contributions up to the family maximum, but their combined contributions cannot exceed the family limit. It’s important to note that HSAs are individual accounts, and married couples cannot maintain a joint HSA.

Scenario: Both Spouses Have Self-Only Coverage

In the situation where both spouses have self-only HDHP coverage, the special rule for married individuals does not apply. Each spouse’s contributions will be subject to the self-only limit, including any catch-up contributions if they meet the age requirement. One spouse cannot increase the other spouse’s maximum HSA contributions by contributing less.

Maximizing Contributions

If both spouses with self-only coverage each maintain HSAs and contribute the maximum amount, their aggregate contributions will be slightly more than the family limit ($8,600 versus $8,550). However, they lose the flexibility to place a disproportionate amount of the contribution into one spouse’s HSA. To maximize their aggregate contribution, married couples should:

- Maintain two HSAs.

- Maximize contributions to each HSA.

Considerations for Choosing Coverage

When deciding whether to elect self-only HDHP coverage from their respective employers or family HDHP coverage from one employer, married couples should consider various factors, including:

- Premium costs

- Provider networks

- Deductible and other cost-sharing amounts

- Any spousal surcharges

Understanding HSA contribution limits and rules is crucial for married couples with self-only HDHP coverage. By maintaining individual HSAs and maximizing contributions, they can effectively manage their healthcare expenses. Always consider the broader implications of your HDHP coverage choices to ensure you make the best decision for your financial and healthcare needs.

Source: Thomson Reuters