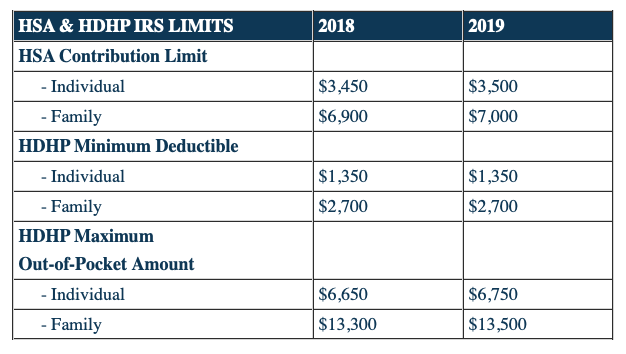

The IRS has announced the 2019 HSA maximum contribution limits detailed in the newly released Revenue Procedure 2018-30. HSA contribution and plan limits will increase to $3,500 for individual coverage and $7,000 for family coverage. Changes to these limits will take effect January 2019.

HSAs are tax-exempt accounts that help people save money for eligible medical expenses. To qualify for an HSA, the policyholder must be enrolled in an HSA-qualified high-deductible health plan, must not be covered by other non-HDHP health insurance or Medicare, and cannot be claimed as a dependent on a tax return.

Questions? Contact us at 855.890.7239 or send an email to customerservice@nuesynergy.com.