In the past, employers decided how much money employees could contribute to their FSAs; there was no statutory maximum. However, the Affordable Care Act changed that: as of January 1, 2013, employee contributions to a Flexible Spending Account are limited to $2,500 per year, indexed for inflation. In 2016, the cap is $2,550.

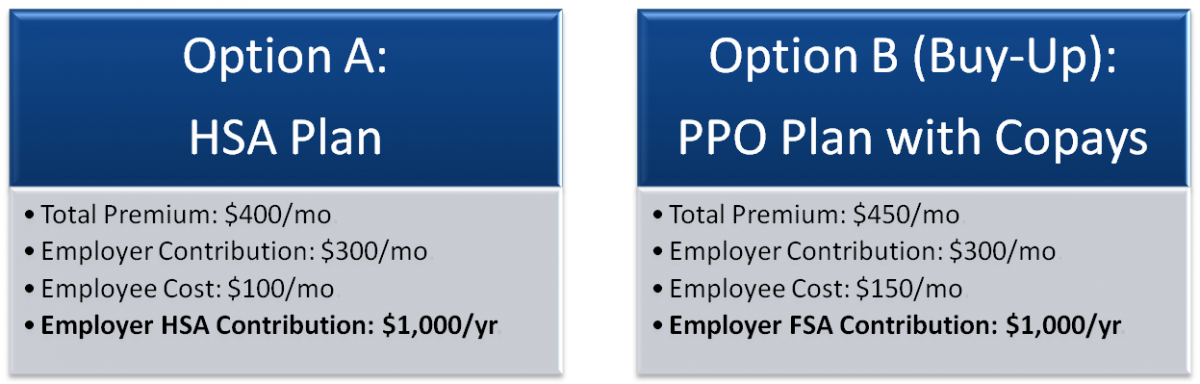

What some people don’t realize, though, is that employers can also contribute funds to their employees’ FSAs. This can be a great strategy for companies that offer a dual option to employees. For example:

For companies that would like to contribute to their employees’ Flexible Spending Accounts, though, there are some rules which are outlined in IRS Notice 2013-54 and embedded in the tax code:

“a health FSA may be considered to provide only excepted benefits if other group health plan coverage not limited to excepted benefits is made available for the year to employees by the employer, but only if the arrangement is structured so that the maximum benefit payable to any participant cannot exceed two times the participant’s salary reduction election for the arrangement for the year (or, if greater, cannot exceed $500 plus the amount of the participant’s salary reduction election).

What, exactly, does this mean? Basically, an FSA, just like a health reimbursement arrangement or an employer payment plan, is considered to be a group health plan subject to the market rules applicable to group health plans (including the annual dollar limit prohibition and the preventive services requirement). However, FSAs that are treated as “excepted benefits” are exempt from these rules. Without getting too detailed, FSAs should definitely be structured to be excepted benefits to stay in compliance, so here are the rules in plain English:

1. First, the employer must offer group health coverage to the employees separate from the FSA. An employer cannot offer a Flexible Spending Account if there is no underlying group health plan.

2. The total amount available to each employee (the employer and employee contributions together) cannot exceed two times the employee’s salary reduction. Essentially, this means the employer could offer a matching benefit. If the employee puts in the maximum of $2,550, for example, the employer could contribute an equal amount because the total amount available would be twice the employee’s salary reduction. Alternatively, if the employee only contributes $1,000 to her FSA, the employer could contribute no more than $1,000. If the employer contributed $2,000, for instance, then the total amount available—$3,000 in this example—would be more than twice the employee’s salary reduction.

3. If greater, the total amount available to the employee cannot exceed the employee’s salary reduction plus $500. This would come into play if the employee contributes $500 or less to the FSA. For instance, if the employee contributes $0, twice the salary reduction amount would still be $0. However, the salary reduction plus $500 would total $500.

4. Long story short, if the employee contributes between $0 and $500 to his her FSA, the employer can contribute up to $500. If the employee contributes more than $500, the employer could match the employee contribution. Any additional employer contribution would cause the FSA to be defined as a group health plan that does not consist solely of excepted benefits and would be out of compliance.

If you’d like to learn more about how you can contribute to your employees’ Flexible Spending Accounts, contact NueSynergy today. We’ll be happy to help.