Are you a broker who’s been recommending self-insured, level-funded plans to your small group clients? If so, you’re not alone – more and more small employers, in an effort to keep premiums under control, are bailing on the small group market and taking advantage of one of the many self-funded options being offered to companies with as few as two employees. In the past, most brokers wouldn’t have even considered self-insuring a company with fewer than a hundred workers, and many would have set the cutoff point even higher. So why now?

The short answer is that the Affordable Care Act changed all of the rules. Younger, healthier small groups, which historically have been rewarded with below-average premiums for their relatively low claims risk, can expect their costs to go up under the new modified adjusted community rating rules. The community rating guidelines do not permit medical underwriting in the small group market, so healthier companies are being forced to pay more in order to offset the costs of older, sicker groups. It’s not fair, but it is reality.

Self-funded plans offer a great alternative: healthy companies are able to dodge the new rules and might even get a refund if they have a good year. Still, not everyone is sold on self-funding, and some companies won’t actually benefit.

For instance, a company with 25 employees might have one worker with a serious medical condition. Under a partially self-funded arrangement, the employer would cover a portion of the cost for that employee, up to a stop-loss amount, at which point the reinsurance would kick in and cover the remaining amount. Unfortunately, the expected claims costs for this employee will be reflected in the rates, so the company will pay a higher monthly amount if it’s not declined altogether.

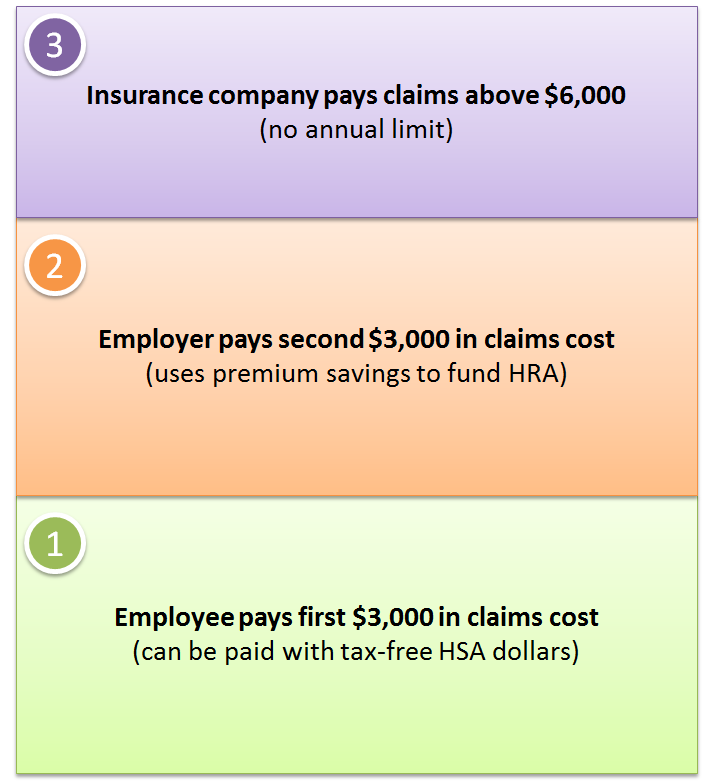

There is another option, though. The employer can purchase a fully-insured plan in the small group market, where it won’t pay more for the sick worker, and “self-insure” a portion of the out-of-pocket costs with a Health Reimbursement Arrangement (HRA). Sure, the employer will incur some predictable HRA claims on that one employee, but if the rest of the company’s employees have a good year the employer could still come out ahead. Perhaps it will help if we put some numbers to it. We’ll keep the math easy.

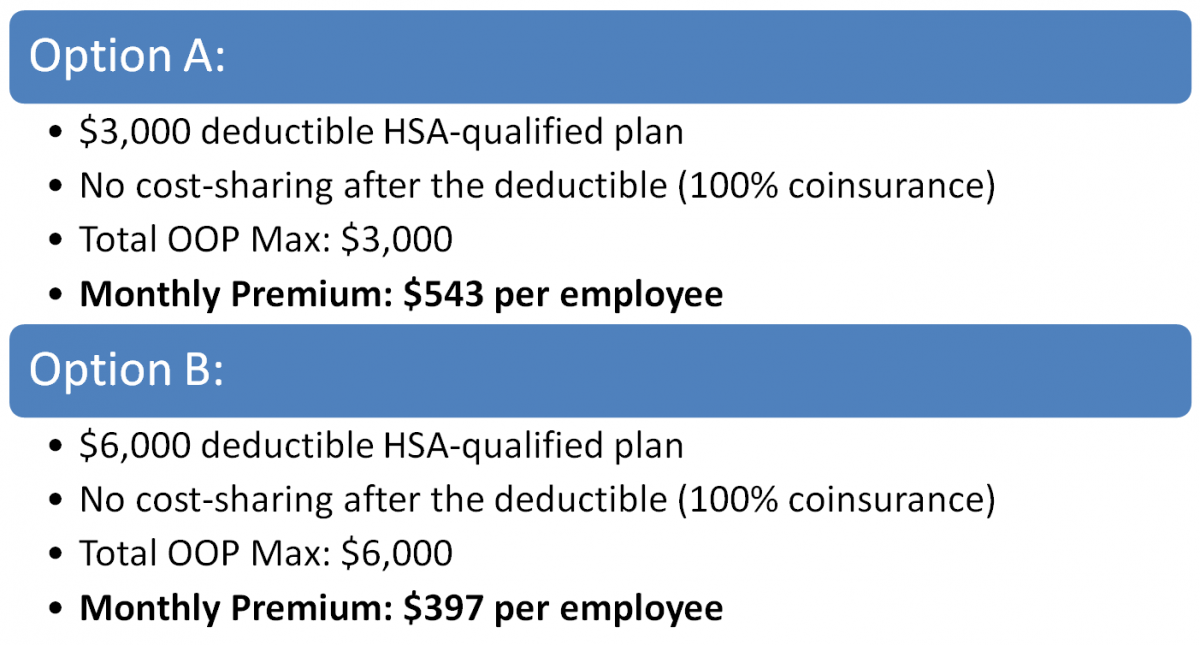

Assume the company has these two options: stick with its existing $3,000 deductible HSA-qualified plan or purchase a higher-deductible plan and use a portion of the premium savings to lower the exposure for the employees.